SciELO - Brasil - The Earnings/Price Risk Factor in Capital Asset Pricing Models The Earnings/Price Risk Factor in Capital Asset Pricing Models

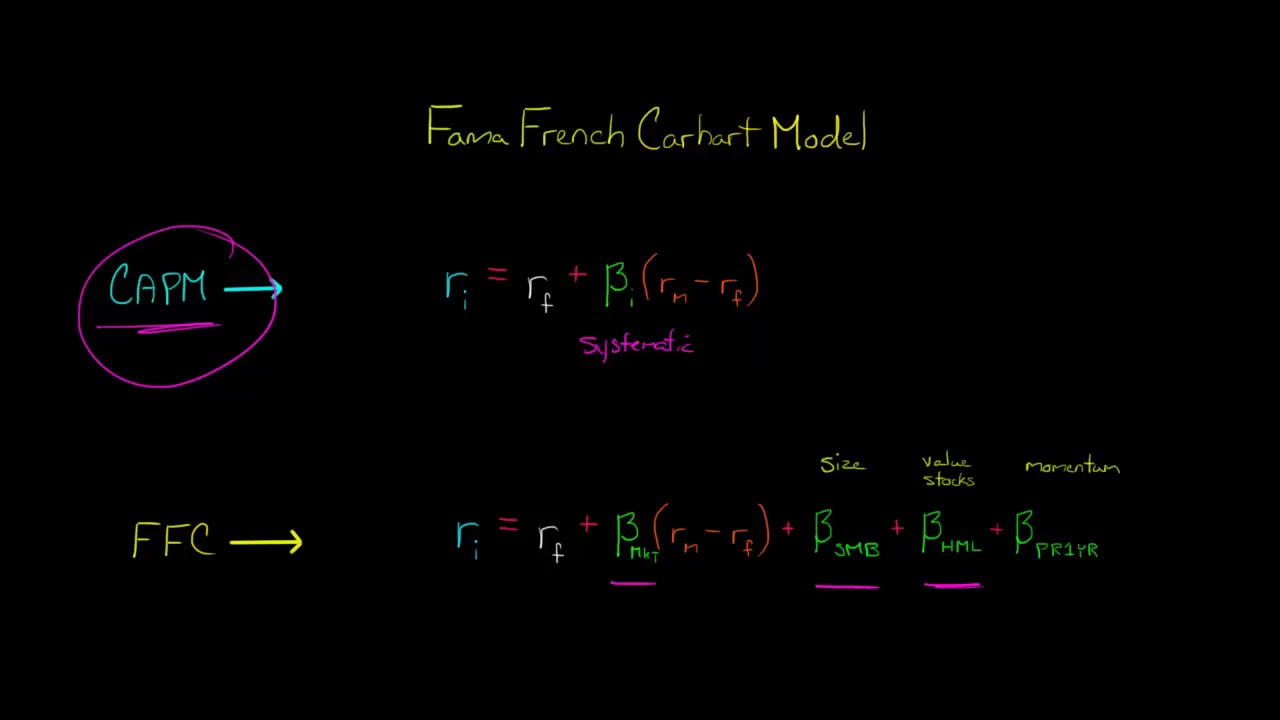

IJFS | Free Full-Text | Pricing Ability of Carhart Four-Factor and Fama–French Three-Factor Models: Empirical Evidence from Morocco

Fama-French 3, Carhart 4, Fama-French 5 Factor models return borderline 0% R2 (max. 6.6%). Time series regression - Quantitative Finance Stack Exchange

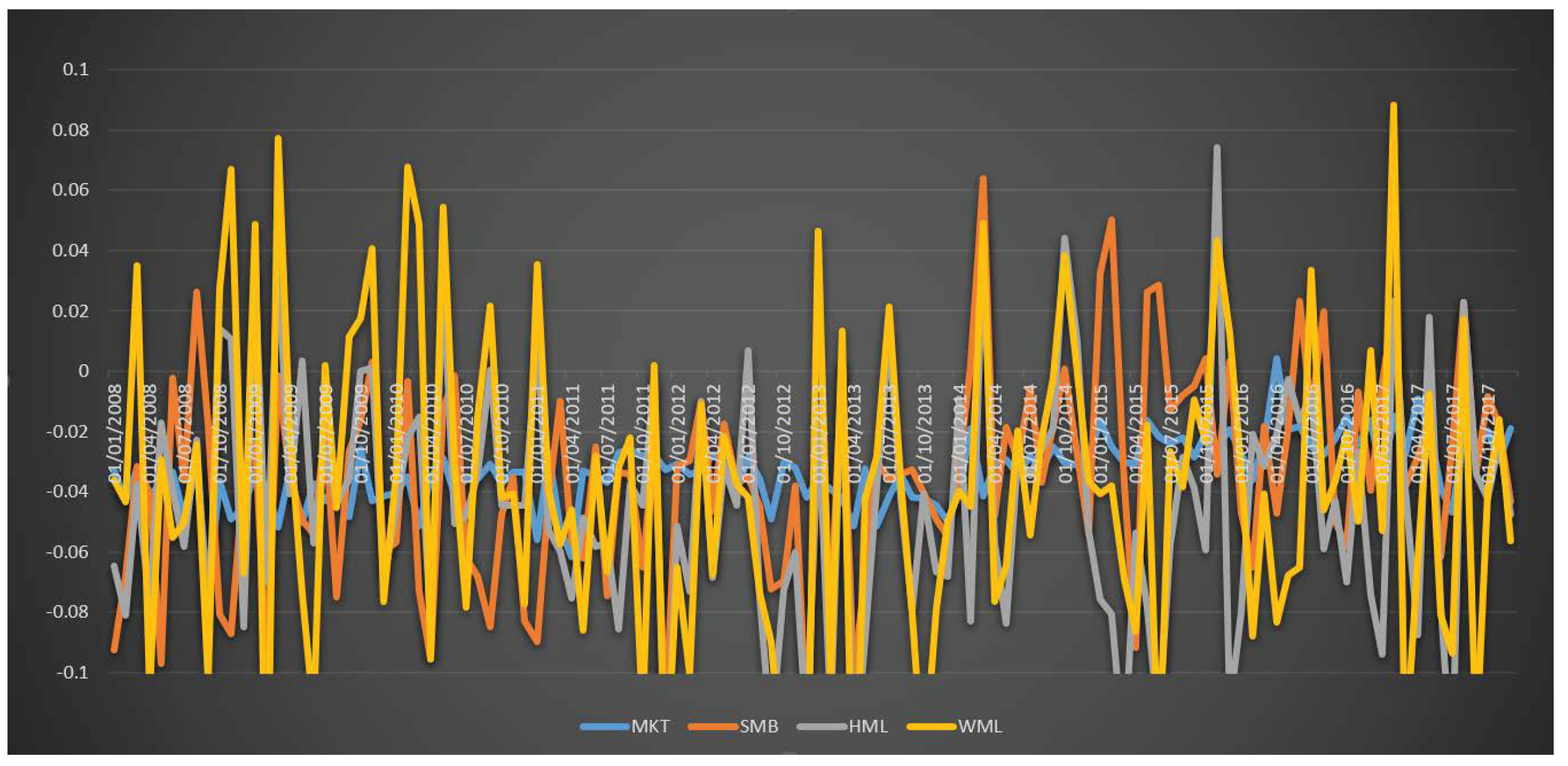

PDF) Testing Carhart Four-Factor Model and Size, Value, Momentum Effects on the Cryptocurrency Market

The pricing of anomalies using factor models: a test in Latin American markets. - Document - Gale Academic OneFile

Constructing and Testing Alternative Versions of the Fama–French and Carhart Models in the UK - Gregory - 2013 - Journal of Business Finance & Accounting - Wiley Online Library

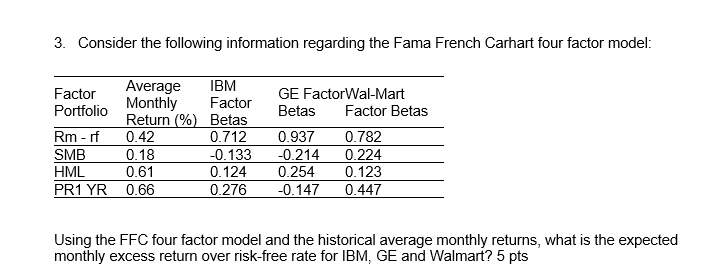

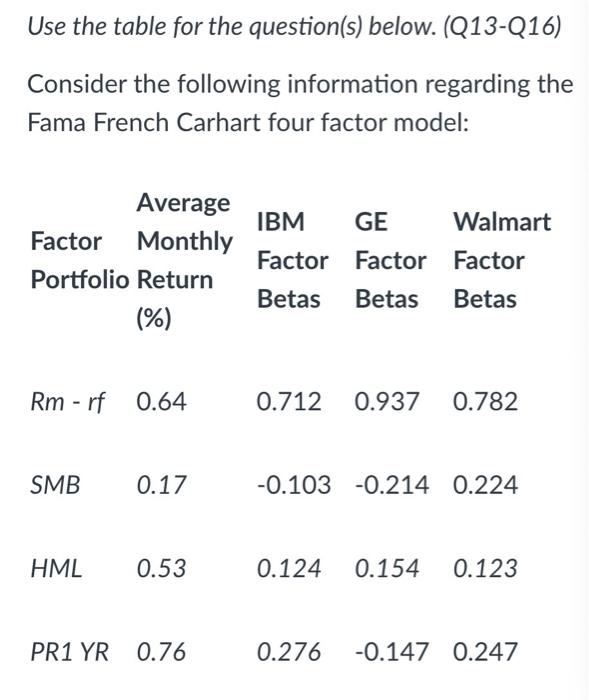

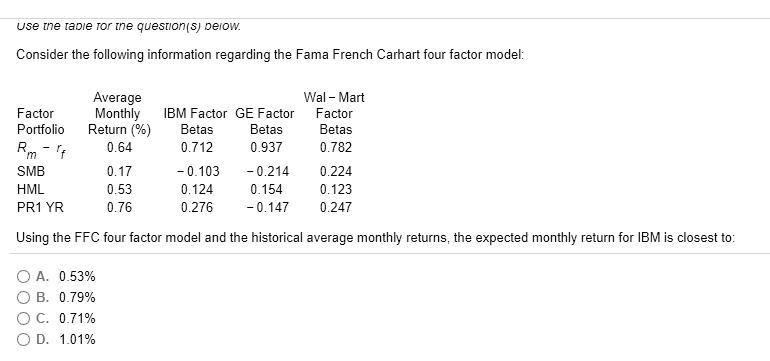

SOLVED: Use tne tabie tor tne question(s) berow. Consider the following information regarding the Fama French Carhart four factor model Average Wal-Mart Factor Monthly IBM Factor GE Factor Factor Portfolio Return (%)

SciELO - Brasil - The Earnings/Price Risk Factor in Capital Asset Pricing Models The Earnings/Price Risk Factor in Capital Asset Pricing Models

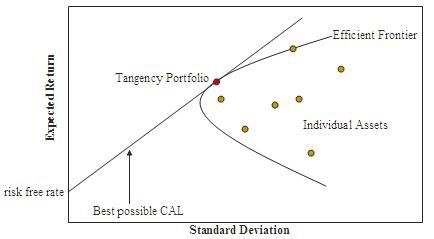

Does the Fama-French three-factor model and Carhart four-factor model explain portfolio returns better than CAPM? : - A study performed on the Swedish stock market. | Semantic Scholar

SciELO - Brasil - The Earnings/Price Risk Factor in Capital Asset Pricing Models The Earnings/Price Risk Factor in Capital Asset Pricing Models