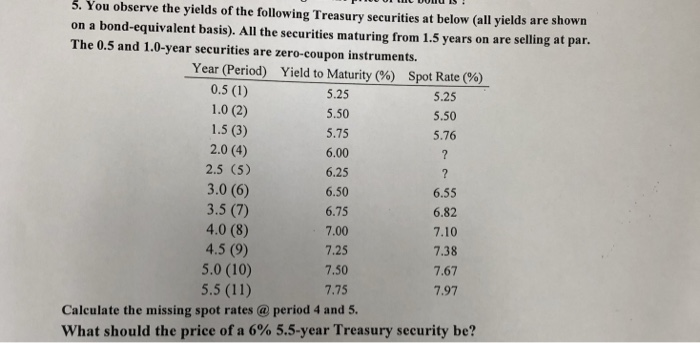

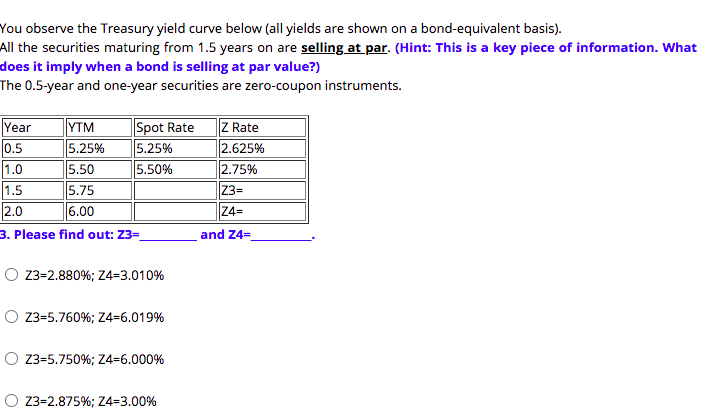

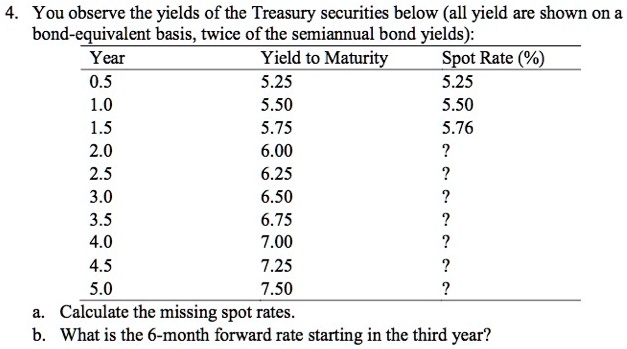

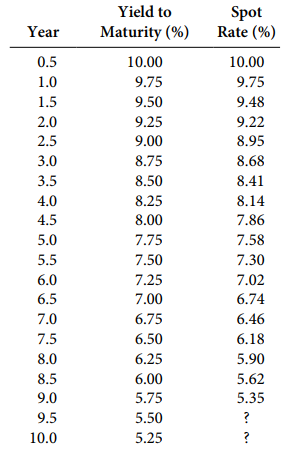

SOLVED: PLEASE SHOW WORKING OUT FOR PART BTHANKS 4. You observe the yields of the Treasury securities below (all yield are shown on a bond-equivalent basis, twice of the semiannual bond yields):

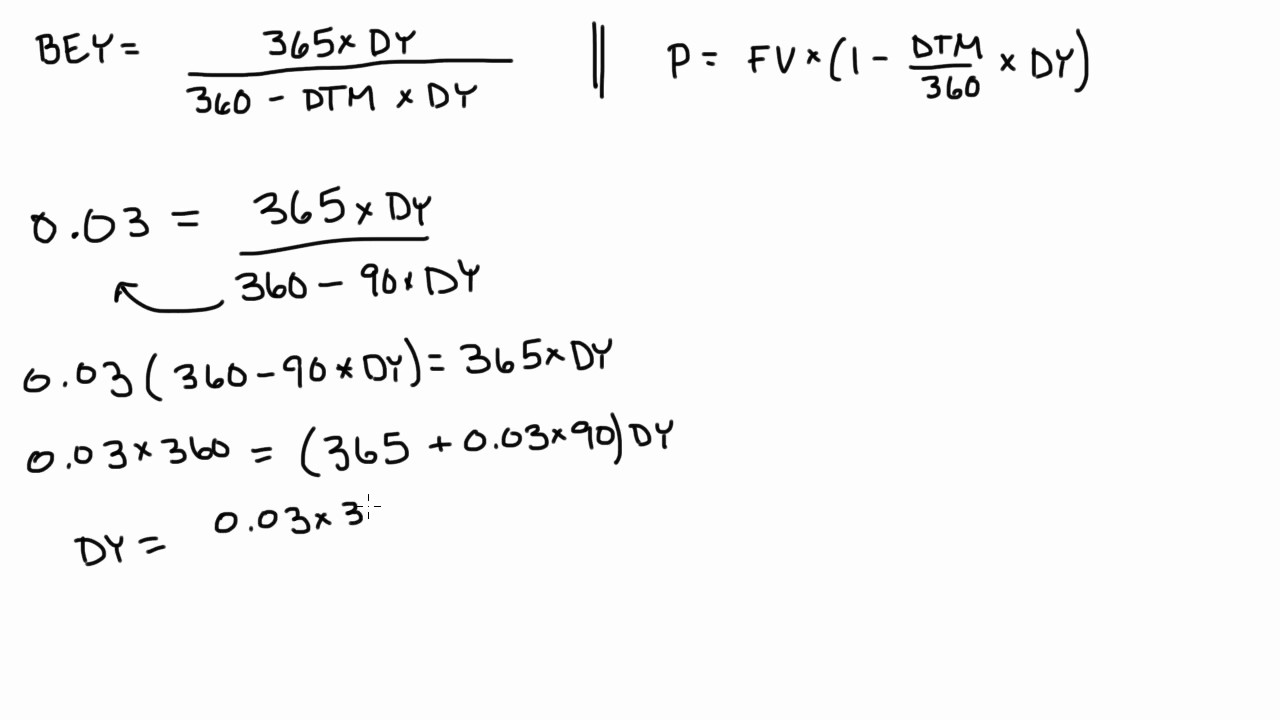

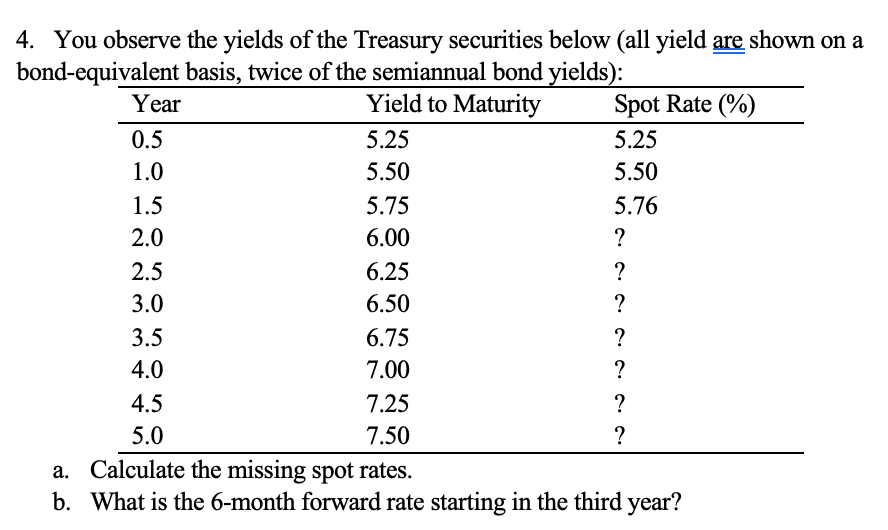

Chapter 7 Money Markets 1. Treasury Bills Pricing of Treasury Bills: – Treasury bills are priced on a bond-equivalent yield basis. The bond- equivalent. - ppt download

Homework 8.xlsx - Q.14 You observe the following Treasury yields all yields are shown on a bond-equivalent | Course Hero

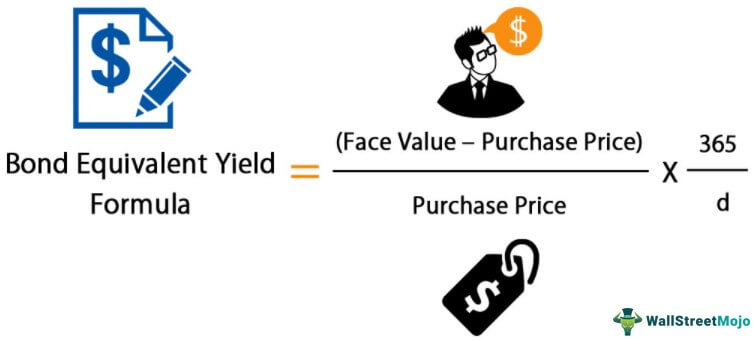

Solved) - You observe the yields of the Treasury securities at the top of... - (1 Answer) | Transtutors

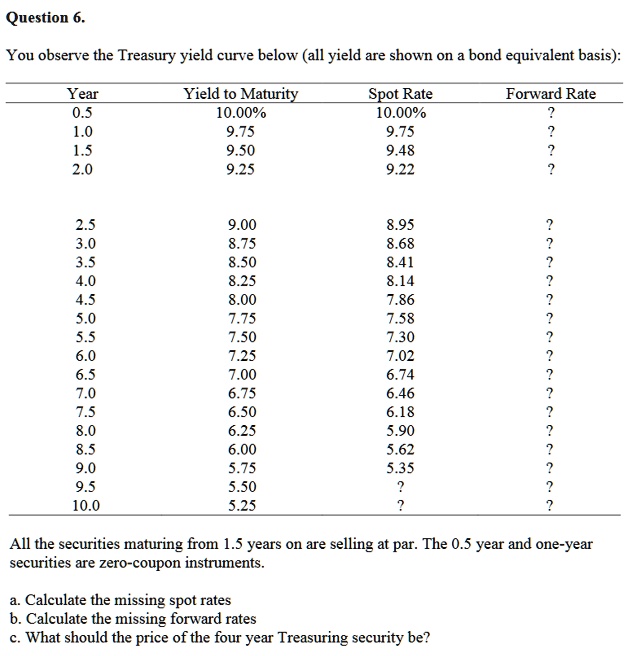

SOLVED: Question 6. You observe the Treasury yield curve below (all yield are shown on a bond equivalent basis) Year 0.5 1.0 1.5 2.0 Yield to Maturity 10.00% 9.75 9.50 9.25 Spot

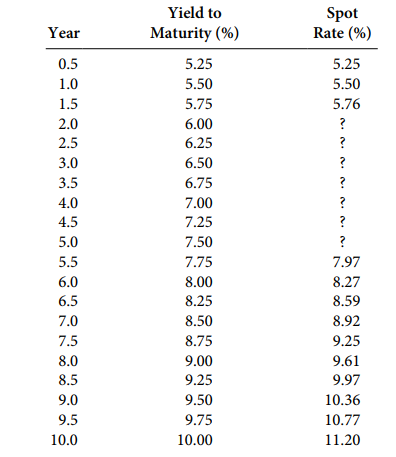

Solved) - You observe the following Treasury yields (all yields are shown on... - (1 Answer) | Transtutors

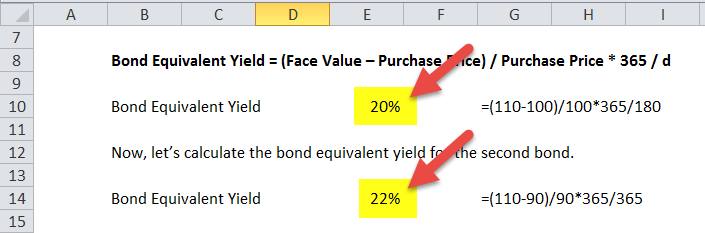

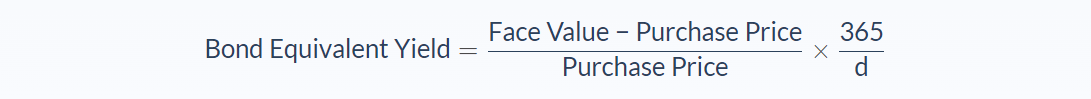

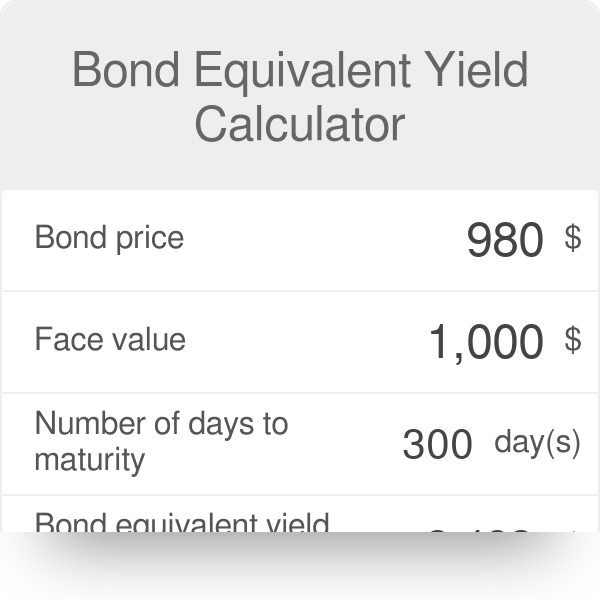

Bond Equivalent Yield Formula & Examples | What is a Bond Equivalent Yield? - Video & Lesson Transcript | Study.com

:max_bytes(150000):strip_icc()/terms_b_bond-yield_FINAL-74bdaeeac8754562855f3aa85ba153c9.png)